LINCOLN, NE – Governor Jim Pillen issued a statement following news that final state General Fund tax receipts for Fiscal Year 2022-2023 exceeded projections by $3 million, which will be transferred into the Cash Reserve Fund.

“This is great news, as we continue the work of providing transformative tax relief to Nebraskans,” said Gov. Pillen. “We continue to work with state agencies to constrain spending. We worked with the Legislature to pass one of the most fiscally conservative budgets in state history – limiting growth to 2%. Those measures, combined with the increase in tax receipts, bodes well for the stability of our state’s economy.”

The state’s revenue receipts for June 2023 exceeded projections by $55.7 million, as reported by the Nebraska Department of Revenue.

The state collected $6.37 billion over the entire fiscal year, $3 million more than projected. The state will put the excess revenue in its Cash Reserve Fund. The better-than-expected collections come a month after Governor Pillen signed tax cuts into law.

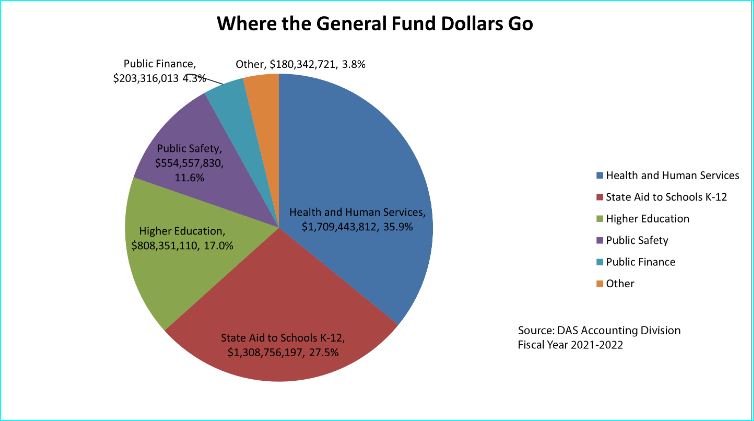

The largest share of State General Fund dollars goes to Aid to Education and Health and Human Services. Also, funds are appropriated for Public Safety (including Department of Corrections, State Patrol, and Supreme Court operations), Public Finance (including Homestead Exemption, Aid to Cities, Counties, and Natural Resource Districts, and Teachers, Patrol, and Judges retirement) and other areas (including Economic Development, Game and Parks, Agriculture, Natural Resources, and transportation).

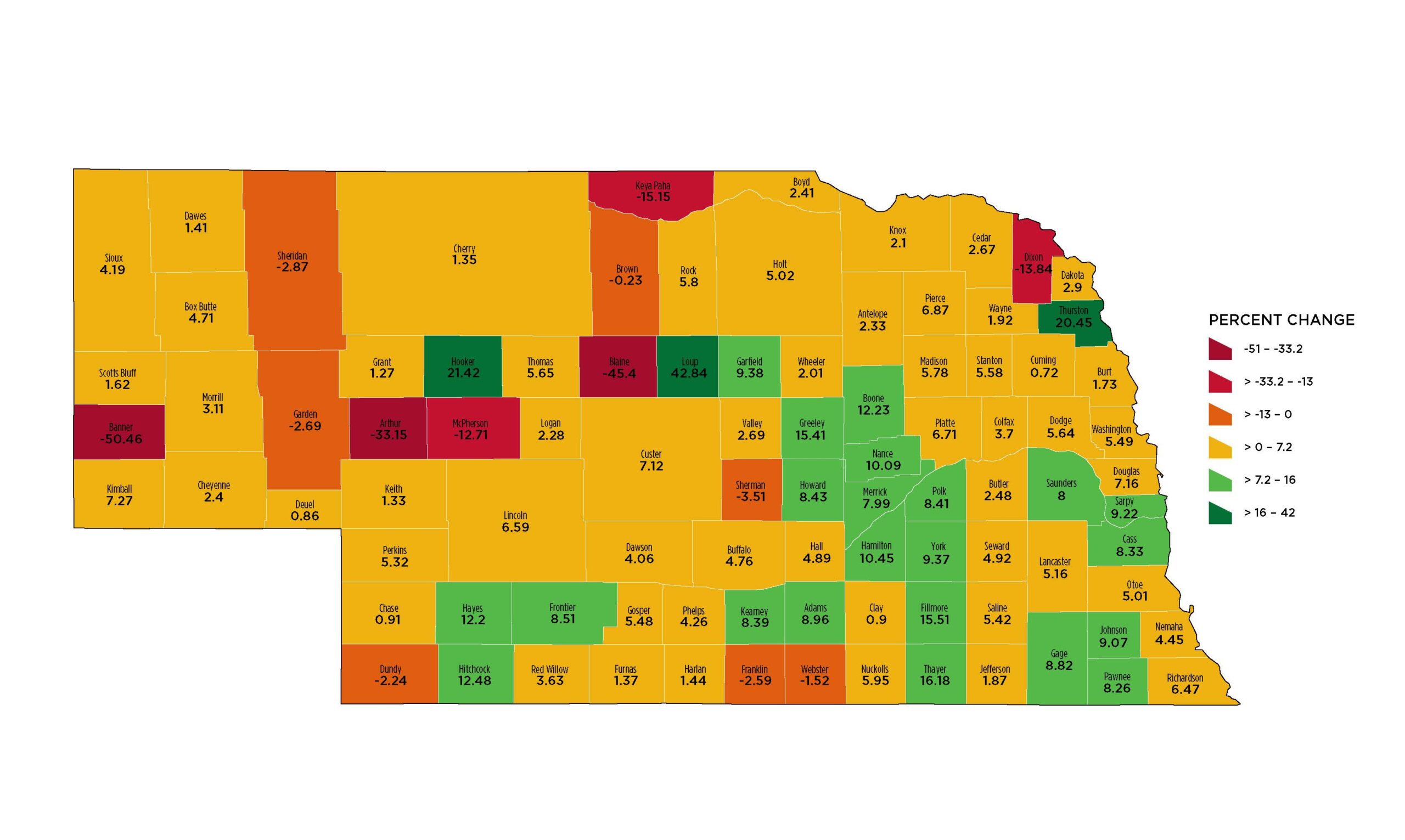

The map below represents the net taxable non motor vehicle retail sales percentage change in each county throughout Nebraska between the fiscal year ending in June 2023 and the prior fiscal year ending in June 2022. The map shows that 80 of the 93 counties have seen an increase in net taxable non motor vehicle retail sales from the prior fiscal year.

According to Dr. Melissa Trueblood, Economist at the Nebraska Public Power District, “many of Nebraska’s counties are continuing to see growth in net taxable non motor vehicle retail sales that started during the COVID-19 pandemic. While the net taxable non motor vehicle retail sales increase between the fiscal years ending in June 2022 and June 2023 have not been quite as great as the growth between the fiscal years ending in June 2021 and June 2022, growth remains strong, especially in many non-I-80 counties. The counties along I-80 were particularly hard hit by the pandemic due to fewer interstate travelers due to COVID-19. Despite an uptick in online sales during the pandemic, many Nebraskans have continued the pandemic era trend of shopping locally.”

Source: Official Nebraska Government Website

Map Provided by NPPD Economic Research Specialist, Tricia Moyer